Listen here on Spotify | Listen here on Apple Podcast

Episode recorded on August 31, 2023

Episode released on January 11, 2024

Megan Hart is a Managing Director at Aon, a global professional services company. Megan’s work focuses on catastrophe management linked to risk transfer in insurance as well as climate risk advisory. Aon’s Reinsurance Solutions works with insurance companies to determine how best to transfer risk to reinsurance companies.

Megan Hart is a Managing Director at Aon, a global professional services company. Megan’s work focuses on catastrophe management linked to risk transfer in insurance as well as climate risk advisory. Aon’s Reinsurance Solutions works with insurance companies to determine how best to transfer risk to reinsurance companies.

Highlights | Transcript

Aon is a professional services company with ~ 50,000 employees working in 120 countries globally. The podcast focuses on Megan’s work on the analytics that support the transfer of risk related to natural hazards from insurance companies to the reinsurance industry, but Aon as a broker does not carry any risk.

State Farm and Allstate recently pulled out of California and Florida. These trends may be related to rising systemic risks caused by droughts, floods, wildfires, etc., and inflationary environment. Insurance companies can address these issues by raising premiums but the regulatory environments in some states can make this challenging. Some of these are described in Gall et al. 2023, The Conversation.

Aon published their annual report titled Weather, Climate and Catastrophe Insight Report in 2023.

Key findings in the report include:

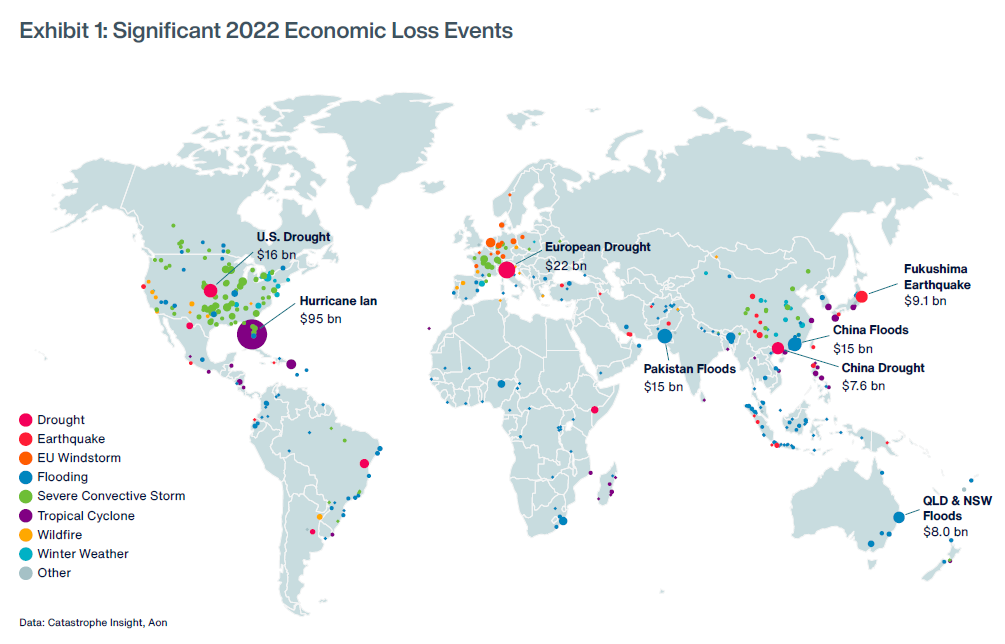

- global natural disasters, total economic costs: $313 billion in 2022, close to average for 21st century

- insurance covered 132 billion of the economic losses, 42% insurance penetration, 58% insurance protection gap

- Critical events in 2022: Hurricane Ian, $95 billion; European droughts, $22 B, US drought, $16 B etc.

- 2022 5th costliest year on record for insurance companies

Communities with insurance are more resilient to natural hazards, which is why it is important to reduce the insurance protection gap as much as possible. Consideration of more non-traditional insurance products, such as parametric insurance, which is triggered by hazards rather than actual losses, can help make insurance more broadly available. Parametric products are not indemnity products (not based on actual losses requiring adjustors), so can be less costly to deploy and more broadly available, e.g., in more developing countries.

Fatalities from natural hazards: 31,000 in 2022 (19,000 related to heatwaves in Europe)

255,000 in 2010

245,000 in 2008

Earthquakes are leading cause of fatalities, 50,800 fatalities in 2023 from earthquake in Turkey.

Insurance industry has been most focused on the acute perils (hurricanes, floods, severe convective storms, wildfires, earthquakes, winter storms); however, there is a recognition for more tools to address chronic perils such as heatwaves, extreme precipitation, freeze risk (may not result in direct physical damage, but may have impacts on business interruption, employee well being, and other insurance lines like general liability, workers compensation, directors and officers).

Weather related disaster fatalities are down because of improved disaster response and adaptation strategies (National Geographic link).

Aon sends teams on the ground post-disasters to learn how to improve community resiliency and disaster response (e.g., wildfires in Maui).

Catastrophe modeling: foundation for assessing insurance risk. Initial development in late 1980s and early 1990s.

Cat models: critical for low frequency, high severity events. Data on these events are limited. Use Cat modeling to fill in the gaps in our data, extrapolate beyond observations.

Specific cat models for different types of catastrophes.

Aon works with academic institutions on building out understanding of risk more broadly due to climate change:

- Columbia University, tropical cyclones

- Central Michigan University and University of Illinois Urbana Champaign on severe convective storm

- University of California (Los Angeles and Merced) on wildfire.

Flood catastrophe models are earlier in their development and maturity timelines than perils like hurricane and earthquake. Residential and small commercial flood insurance coverage typically provided by Federal Emergency Management Agency (FEMA) under National Flood Insurance Program, but only required for regions within 100 yr flood plain for federally backed mortgages. Many people do not realize that they don’t have flood insurance within their standard homeowners insurance policies, making this a significant protection gap here in the U.S.

Increasing recognition of compound events, interconnectedness of perils and global teleconnections (e.g., storm surge + inland flooding, etc) also linkages to supply chain risk.

Risk triangle includes hazards, exposure, and vulnerability.

Need to consider how hazards interact and line up. Increasing volatility in terms of frequency and severity of hazards. Sea level rise and coastal flooding

Risk trends changing partially in response to increased exposure, increasing development in more high risk areas (coastal areas, wildland-urban interface/intermix), and inflation.

Vulnerability of structures, damage curves or vulnerability functions

Communities wanting to reduce risk, where should they invest? Focus on economic impacts to the communities. Insurance Institute for Business and Home Safety (IBHS): non profit funded by the insurance industry, testing structures to reduce risk from reduce risk from wind, hail, wildfire, and rainfall.

OASIS loss modeling framework: Outcome and Assessment Information Set, Aon participates in this open source platform for developing, deploying and executing catastrophe models

Moving forward: focus on innovation and education.